Riding on the wave of technological change in generative artificial intelligence (GenAI), people are full of expectations for this powerful tool that will reduce costs and generate profits.

However, one year after ChatGPT became popular, the GenAI industry has not yet formed a value structure like the current cloud service industry. The latter’s upper-layer applications occupy most of the value chain and obtain most of the profits. The infrastructure software layer Profit comes second, and the hardware layer gets the least “cake”.

In contrast, in the field of GenAI, the hardware layer accounts for nearly 90% of the profit margin. Suddenly looking back, everyone found that the entire industry chain was basically “working” for GPU manufacturer Nvidia.

So, will the current GenAI economic model continue? In what aspects will the future value of this field be accumulated, and how will it be realized? This article interprets the current industry value stratification and profit distribution in the field of GenAI, and predicts future development.

In what areas does GenAI accumulate value?

It has been 18 months [1] since the “iPhone moment of AI (stated by Nvidia founder Huang Jensen in his speech at the GTC conference in 2023)” [1], but the pace of its development has not slowed down. I have been thinking about an important question: In what areas is the value accumulated in the GenAI field now and in the future?

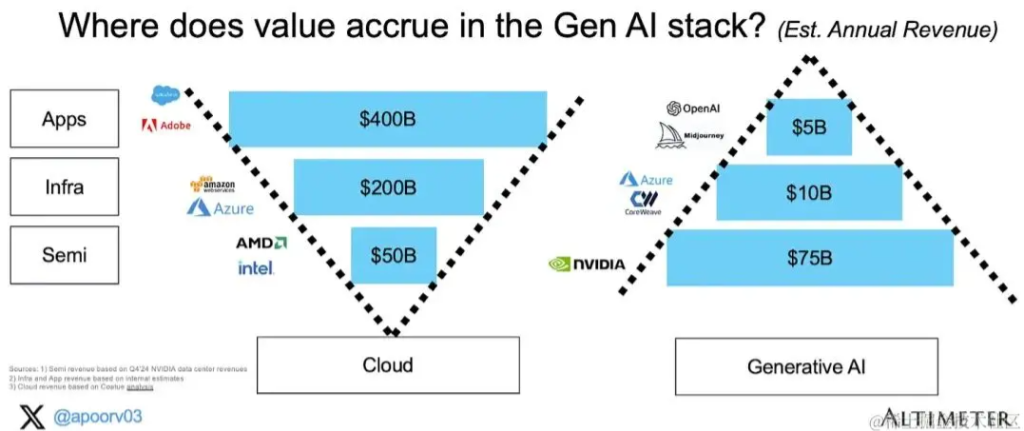

Currently, GenAI’s technology stack value accumulation presents an A-shaped structure, while cloud services present a V-shaped structure [2]:

I divide the technology stack into three layers: semiconductor layer, infrastructure layer and application layer. The following are revenue statistics about GenAI:

Semiconductor layer: Nvidia’s data center revenue last quarter (ending January 2024) was about $18 billion, and given that it has more than 95% market share, annual revenue from this segment is expected to be about $75 billion.

Infrastructure layer: This layer includes hyperscale computing providers (AWS, GCP, Azure) and major inference cloud (Coreweave, Lambda, etc.) providers. It is roughly estimated that the annual revenue of this layer is about 10 billion US dollars.

Application layer: large language models (OpenAI, Anthropic, xAI, etc.), image models (Midjourney, etc.) and other purely generative AI applications. Some GenAI use cases may disguise revenue as “software” revenue, so I would venture to estimate that annual revenue at this layer is about $5 billion.

In contrast, the cloud economy exhibits a more “intuitive” value distribution – applications closer to end customers can earn more value.

The semiconductor layer currently accounts for approximately 83% of the annual revenue of the GenAI technology stack ($75 billion of the $90 billion revenue), which is much higher than the approximately 10% annual revenue that semiconductors currently account for in the cloud technology stack!

In what areas does GenAI accumulate profits?

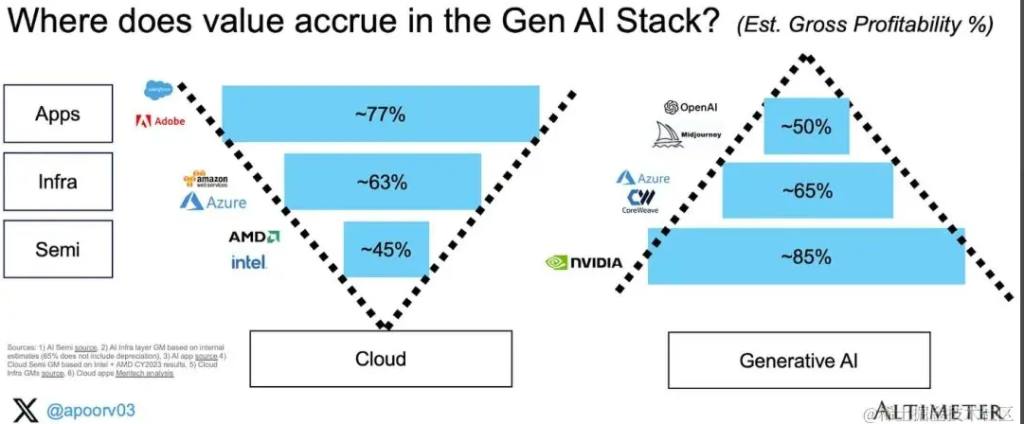

As shown in the figure below, we can also see the inverted structure of profit margins, with the semiconductor layer currently occupying the highest share [3]:

Here are the statistics:

Application layer: It is estimated that Anthropic’s gross profit margin is about 50-55%. I assume the gross margin is the same across the application tier.

Infrastructure layer: I estimate gross margins for infrastructure vendors at around 65% (excluding GPU depreciation). If depreciation is included, this number drops to 25-30%.

Semiconductor layer: NVIDIA’s gross margin on its GenAI data center products is estimated to be over 85%.

The cloud tech stack situation has been well-studied, except for hyperscale gross margins. Azure’s gross margin is estimated to be approximately 63%, and we assume this number applies to all infrastructure tiers.

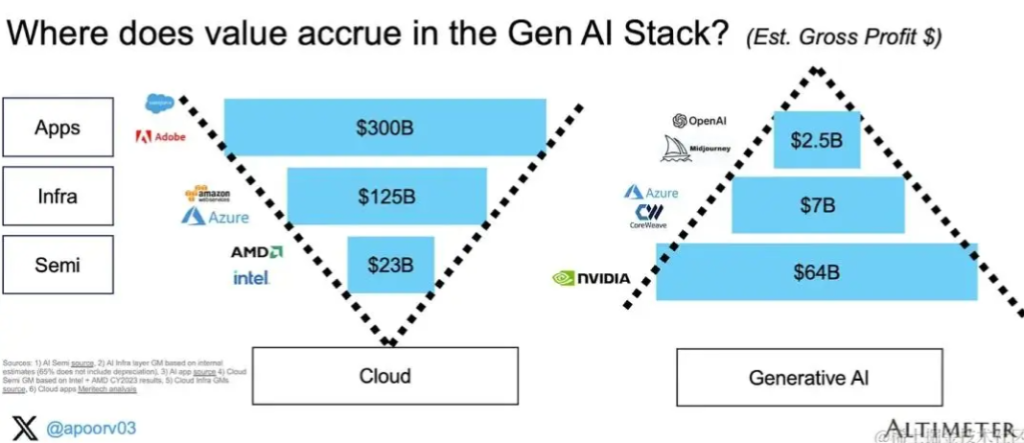

Taken together, the total gross profit was mainly concentrated in the semiconductor layer, earning a profit of US$64 billion (a total of US$73 billion). See the chart below (Revenue x Gross Margin %):

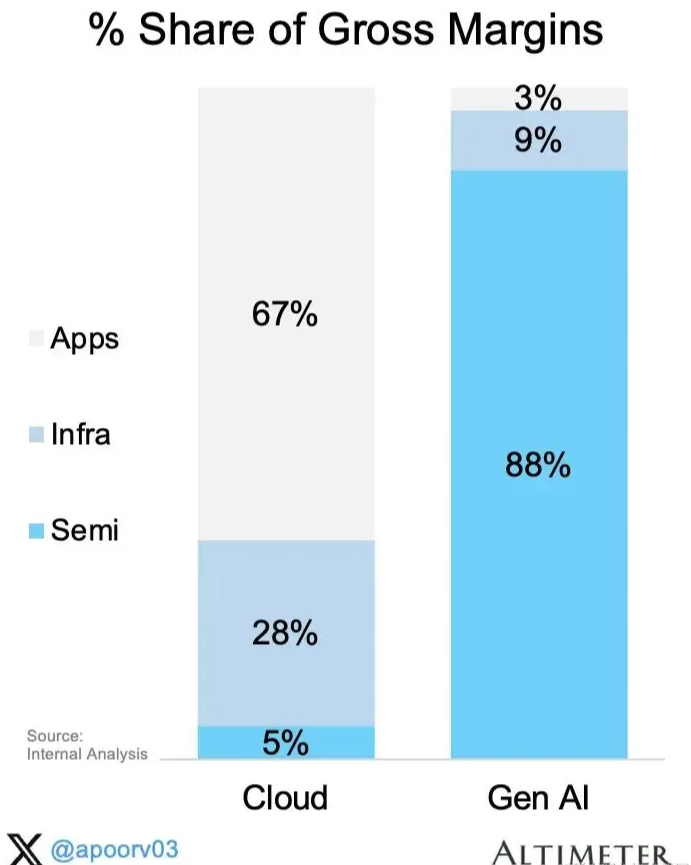

It is necessary to visualize this surprising relative proportion using a bar graph. Here we assume that 100% represents the total gross profit margin in the system.

Conclusion: The semiconductor layer currently accounts for approximately 88% of the total gross profit margin in the GenAI ecosystem (while in the cloud technology stack, semiconductor gross profit margin only accounts for 5%).

What is the future direction of development?

We are in the early stages of a platform transformation where the semiconductor industry captures most of the value, but I don’t think GenAI’s current revenue structure (inverted pyramid) will remain the same. I expect that the application layer will take over in due time. Similar high proportions across the value chain.

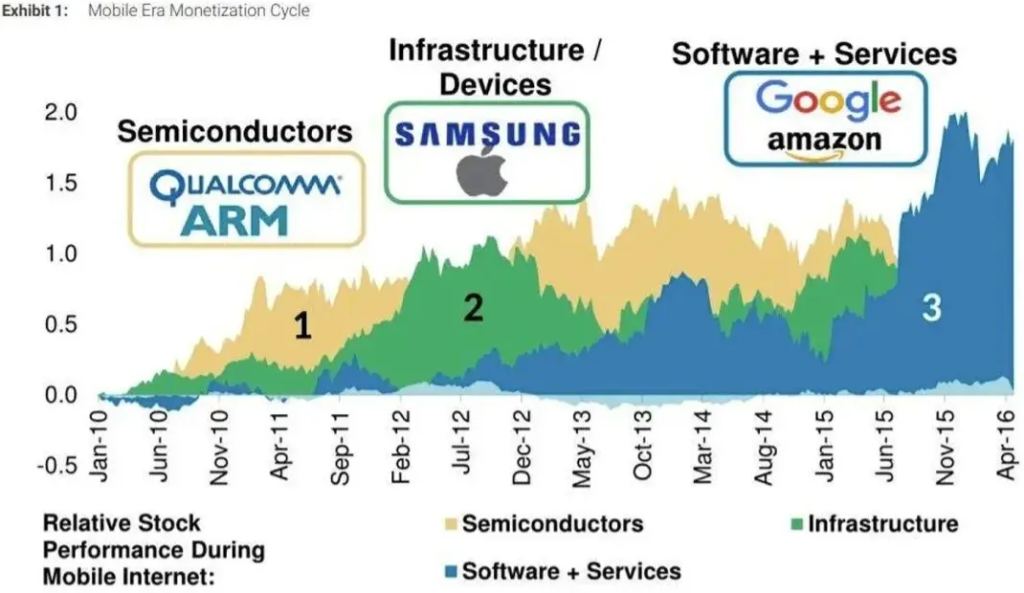

Here are case studies on value accumulation during the mobile wave. Over the past decade, value in the field of mobile intelligence has accumulated first at the semiconductor layer, then at the infrastructure layer, and finally at the software layer:

Similarly, in cloud computing, we first witnessed the construction of data centers, followed by the rise of cloud service providers. AWS started in 2004 and got its first customers in 2010-2012 (Amazon switched to AWS in 2010 and Netflix joined them in 2012).

I predict that GenAI will develop in the same way. We are currently in the first phase (semiconductors) and are expected to enter the third phase (applications) in 2030. It can be deduced from this that due to the current low base, I think there will be the most opportunities in the application layer technology stack in the future!